W*RK – It’s Not Just Anther Four-Letter Word

Problems with Work: Fruitless, Selfless, Pointless, Idols

May 8, 2016

Tom Arthur

Peace friends!

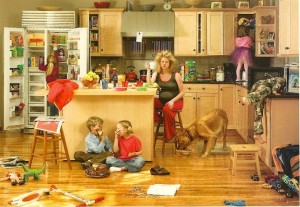

Any moms in the house? Any moms ever experience problems with making the work of being a mom mix with the work you get paid for? When it comes to moms, I think this is what moms want to do:

This is what your kids want you to do:

This is what your husband wants you to do:

This is what you really do:

Happy Mother’s Day!

Today we’re continuing a series called W*RK: It’s Not Just Another Four-Letter Word. Somehow it seems appropriate to explore this topic on Mother’s Day. But the timing was actually more of a coincidence. And yet there are a lot of tedious things that moms do in their work, just like the tedious things we all have to do in our work. I asked my friends on Facebook what was the most tedious part of your job? I got LOTS of answers. Here’s a sampling:

- Answering repetitive questions from customers

- Grading

- Fighting with computers!

- Meetings. Meetings. Meetings. Meetings.

- Voicemail

- Picking up poop

- Dealing with either difficult, self-centered people or insincere, backbiting people.

- Getting an email from someone standing right next to you

- Proofing/editing long, wordy facility contracts

- Doing internal/external audits of files!

- Putting up with racial jokes

One person turned my question on its head saying:

“It used to be cleaning toilets, but when I noticed my attitude and how cleaning toilets seemed to never end! I asked the Heavenly Father to remind me of when I didn’t have those toilets to clean, and how I couldn’t pay for rent, and let me be forever grateful for those toilets! 2 years later I actually smile when I’m cleaning the toilets.”

This person’s great attitude aside, some work is just plain tedious, hard and grueling! I spoke with someone in our church who may just have the most grueling job of all. Sean Ely works on a road repair crew. From April to November he pretty much works seven days a week. The last couple of shifts have been thirty-six-hour shifts! Thankfully the imbalance in the summer is met with time off not working from December to March. He’s worked this job for eight years, but he’s looking for another job. I asked Sean how he gets through it. He said that he prays each day before work. He prays for protection for himself and his crew. He pointed out that highway repair is one of the top ten dangerous jobs. People speed through construction zones while texting, drinking, or driving recklessly. While the job is grueling at times, Sean abstains from using illicit substances on the job like some of his co-workers. He does his best to be a positive encouragement to those around him trying to not get sucked into their negativity. He told me he wasn’t always like this. In his 20s he did a lot of drugs and drank a lot. But now he leads others and serves God by doing excellent work. He pays attention to detail and has a 100% safety track record. No crashes and no damaged equipment in eight years! Other foremen want him on their crews and seek him out. Of course, while Sean is out working thirty-six hours shifts, his wife Jessica, is at home with the kids. Sean said that it’s Jessica’s support at home that really keeps him going. Some of his crew members have gone through divorce because of the grueling nature of the job and schedule. But Jessica is fully supportive. And in the winter he gets lots of time with the kids.

Sean’s experience shows that some work is hard. Really hard. The question on my mind is this: Why is some work just plain hard? Let’s look back at the beginning of the Bible and see what happens to work pretty quickly after God creates. God puts humans in a garden and tells them they can eat anything in it but the fruit from one tree. Well, you know how this story ends whether you’ve read it or not. They eat the forbidden fruit. And all hell breaks loose. The consequences of disobedience become apparent in what Christians call “the curse.” It’s not so much a curse by God as it is a curse of natural consequences of knowing disobedience. God explains it to Adam and Eve:

To the woman God said,

“I will surely multiply your pain in childbearing;

in pain you shall bring forth children.

Your desire shall be for your husband,

and he shall rule over you.”

And to Adam he said,

“Because you have listened to the voice of your wife

and have eaten of the tree

of which I commanded you,

‘You shall not eat of it,’

cursed is the ground because of you;

in pain you shall eat of it all the days of your life;

thorns and thistles it shall bring forth for you;

and you shall eat the plants of the field.

By the sweat of your face

you shall eat bread,

till you return to the ground,

for out of it you were taken;

for you are dust,

and to dust you shall return.”

~Genesis 3:16-19 ESV

Throughout this series we’re using a book to guide us through the ups and downs of work: Every Good Endeavor by Timothy Keller. Keller says of “the curse” that

“Sin leads to the disintegration of every area of life: spiritual, physical, social, cultural, psychological, temporal, eternal.”

~Timothy Keller

Today I want to look at four problems with work:

- Fruitless work

Sometimes it seems like work just doesn’t produce any tangible fruit. Did you catch this line in the story from Genesis above:

thorns and thistles it shall bring forth for you;

and you shall eat the plants of the field.

~Genesis 3:18 ESV

“Thorns and thistles.” That’s not fruit. It’s painful and hurtful. What are we to think of the “thorns and thistles” in our work? If we’re honest with ourselves some of the “thorns and thistles” in our work has to do with our own unrealistic expectations. The “Greatest Generation”, those who lived through WWII were happy with any job that put food on the table. But given the relative abundance of current times, younger generations, myself included expect to change the world with our work. We’re not content just to put food on the table. We want to make an impact. Leave our mark. While I’m not sure these expectations are all bad, sometimes these expectations can be unrealistic. The world just doesn’t work like that. Our work is never as fruitful as we would like. We can get caught in one of two extremes: Idealism or Cynicism. And yet if we go back to the same “thorns and thistles” passage we read:

thorns and thistles it shall bring forth for you;

and you shall eat the plants of the field.

~Genesis 3:18 ESV

Work on this earth will be thorns and food. I love my job. I love being a pastor. I wouldn’t want to be anything else. Except on those days when I don’t want to be a pastor, and I’d rather be anything else. Yet if we follow Jesus we look for the day when the thorns disappear as God creates a new heaven and a new earth. It’s not Christmas time right now, but the Christmas song, Joy to the World, reminds us of this:

No more let sins and sorrows grow,

Nor thorns infest the ground;

He comes to make His blessings flow

Far as the curse is found,

Far as the curse is found,

Far as, far as, the curse is found.

One problem with work is that until Jesus returns, work will always be a mix of thorns and fruit.

- Pointless work

A second problem we all experience with work is pointless work. We’re not alone. The writer of Ecclesiastes, a wisdom book in the Bible, says:

So I came to hate life because everything done here under the sun is so troubling. Everything is meaningless—like chasing the wind.

~Ecclesiastes 2:17 NLT

Do you ever feel like your work is pointless and meaningless? Sometimes this is part of a bigger problem. The Agnostic Pub Group that I co-lead with my atheist friend is currently reading a book of essays by C.S. Lewis, best known for his book The Chronicles of Narnia. One of those essays is a transcript of a Q&A Lewis did with a group of industrial workers. Here’s how he began to Q&A:

“My own idea is that modern industry is a radically hopeless system. You can improve wages, hours, conditions, etc. but all that doesn’t cure the deepest trouble: i.e., that numbers of people are kept all their lives doing dull repetition work which gives no full play to their faculties. How that is to be overcome, I do not know.”

~C.S. Lewis (God in the Dock, Answers to Question on Christianity)

Many of us are stuck screwing sprockets, crunching numbers, answering endless calls, sorting paper, or fielding complaints. It all feels meaningless and pointless. I’ve found the solution to this problem. It’s really quite simple. Here’s what I do to get rid of all my meaningless pointless work: I give it to my staff! OK, so that fixes it for me, but not them.

Given the pointlessness of our work, maybe we should just make as much money as possible so we can buy as many pleasures as possible for the time we’re not working? This too is meaningless! The writer of Ecclesiastes who was very wealthy says:

Anything I wanted, I would take. I denied myself no pleasure. I even found great pleasure in hard work, a reward for all my labors. But as I looked at everything I had worked so hard to accomplish, it was all so meaningless—like chasing the wind. There was nothing really worthwhile anywhere.

~Ecclesiastes 2:10-11 NLT

One of the problems here is that we have may have chosen a job based on money rather than one based on your abilities. You just might be more content if you took a job that paid more but did work that was more in line with your passions. Or maybe you take the money you make and you use it to some other ends. Throughout this series we’re looking at eight ways we serve God at work. Here’s the list of all eight:

8 Ways to Serve God at Work:

- Do skillful, excellent work.

- Further social justice in the world.

- Create beauty.

- Work from a Christian motivation to glorify God, seeking to engage and influence culture to that end.

- Work with a grateful, joyful, gospel-changed heart through all the ups and downs.

- Do whatever gives you the greatest joy and passion.

- Be personally honest and evangelize your colleagues.

- Make as much money as you can, so that you can be as generous as you can.

Focusing in on number eight right now, maybe you work hard at what seems like pointless work, but you’re making a lot of money doing this pointless work. And so the question becomes, what do you do with that money? Maybe the point of making the money isn’t to spend it on your pleasures, but to be generous with God’s work in the world. You give to the church. You give to charities. You give to the people around you who are in need. You combat pointless work with generosity.

We’ve looked at fruitless and pointless work. A third problem with work is selfish work.

- Selfish work

A couple of months ago we took a whole series to look at the book of Esther in the Bible. Esther is a story of a young Jewish woman in Persia named Esther. The king of Persia holds a beauty pageant to find the next queen. Esther, a Jew, wins! Shortly thereafter the Jews are under threat of genocide.

Esther has to choose: try to hide her Jewishness and keep the privileges of her job, or risk her privileges for the sake of her people. Mordecai, her uncle, tells her:

Who knows if perhaps you were made queen for just such a time as this?

~Esther 4:14 NLT

You “were made.” In other words, you were put here, brought here, not by what you did but by grace. It was a gift. You didn’t earn your beauty. You didn’t earn your position. It was given to you. What will you do? Will you turn it toward your own selfish pursuits or will you use your privilege to help others? Esther ultimately identified with the Jews and said “if I perish I perish.” She used her work to the good of others rather than her own good. Esther is a foreshadow of Jesus who Jesus identified with us after leaving the palace of heaven and perished, died, so that we might have new life. What will you use your work for? Yourself or others? Dorothy Sayers, an author and friend of C.S. Lewis, said:

“The only true way of serving the community is to be truly in sympathy with the community, to be oneself part of the community and then to serve the work…It is the work that serves the community; the business of the worker is to serve the work.”

~Dorothy Sayers

None of us have perfectly pure motives. None of us work entirely for other-centered reasons. We all need the mercy and grace of Jesus Christ to heal and free us from our selfishness. Timothy Keller says:

“Unless you use your clout, your credentials, and your money in service to the people outside the palace, the palace is a prison; it has already given you your name.”

~Tim Keller (119)

We’ve looked at three problems with work: pointless, fruitless, and selfish work. There’s one more problem.

- Idolatrous work

Shortly after the telling of the story of creation in the book of Genesis in the Bible, we come to the story of the Tower of Babel. Here’s what the people of the earth say:

“Come, let us build ourselves a city and a tower with its top in the heavens, and let us make a name for ourselves, lest we be dispersed over the face of the whole earth.”

~Genesis 11:4

We see in their motivation to build this tower two idols: the idol of self and the idol of the group. They idolize themselves when they say, “let us make a name for ourselves.” The idol of self is called “Individualism.” When we worship the self we ignore the needs of others. The subprime bubble is a good example of that. Selling junk subprime mortgages made a lot of money for some individuals while putting many more people underwater in their houses. Work becomes pointless and meaningless when we use it as a way to make a name for ourselves.

The second idol is the idol of the group. The people of the earth idolize the group when they say, “Lest we be dispersed over the face of the earth.” This is called “collectivism.” We idolize the group when we ignore individual needs. The Industrial revolution and the modern assembly line are good examples. Individuals become replaceable cogs in a wheel.

When we work for the idol of self or the idol of the group our work becomes our identity, rather than Christ being our identity. The way we keep work from becoming an idol is we do honest work while turning to Jesus.

I mentioned earlier that throughout this series we’re looking at eight ways we serve God at work. This is where the rubber meets the road. We looked at the last one earlier, let’s look at number seven now:

8 Ways to Serve God at Work:

- Be personally honest and evangelize your colleagues.

- Make as much money as you can, so that you can be as generous as you can.

Let’s be honest. “Evangelizing your colleagues” doesn’t sound very appealing. In fact, it’s probably that kind of Christian that most of us are trying not to be. Some of our workplaces are very unfriendly to faith discussions. I was talking with a social worker in our church who told me that it’s considered unethical to talk to clients about her faith. Another person in our church works in the art world. The arts haven’t always had the best of relationships with the church. His fellow colleagues are suspicious of his involvement with church and his faith. So how do we navigate these challenges? Here are a couple of ideas. Like Sean, we do excellent work. We focus on being the best road repair worker we can be. You live out your faith in a way that makes others wonder what motivates you. When they ask, the door begins to open. If you’re in a workplace where it’s considered unethical to bring up faith with your clients, then you bring it up with your co-workers. How do you bring it up? You participate actively in church. When you’re asked what you did this weekend, instead of dodging the fact that you went to church, you mention it. You pray and you wait for your colleagues to ask you about your church and your faith. You learn to ask them good questions like, “Do you have a church family? What’s your experience of church been? Have you ever had an experience with God?” You go from there. One partner in our church takes our invite cards to our big days and hangs them up in his cubicle. He finds that his colleagues ask him about them. He doesn’t even have to bring it up. As you take small steps, you find that it gets easier. Slowly but surely you are able to talk about your faith with your colleagues in a natural, non-obnoxious way. And you let God do the heavy lifting. Your colleagues’ salvation isn’t in your job description. Jesus already took that tedious grueling job. Your job is simply to be a means of God’s grace in the life of those who you encounter. In this way you serve God when you are personally honest and evangelize your colleagues.

There are a lot of problems with work. Work is sometimes fruitless, pointless, selfish, and idolatrous. We serve God at work when we use our work to make as much money as we can so we can be as generous as we can. We serve God at work when we are personally honest and evangelize our colleagues.

Prayer

God, amidst all the problems we face in work, help us be honest. Help us share our faith with those around us. Help us not be tempted to earn money to spend it on our own passions, but help us to be generous with all that you have given us. Thank you for you grace in your son Jesus Christ, who did the hard grueling work of death on a cross, so that our work here on earth might be redeemed and made new. In Jesus’ name and the power of your Spirit, amen.

Recent Comments